Stock Market Crash: Dow Drops 1,500 Points Earlier This Month

Stock Market Line Chart for the month of February

February 27, 2018

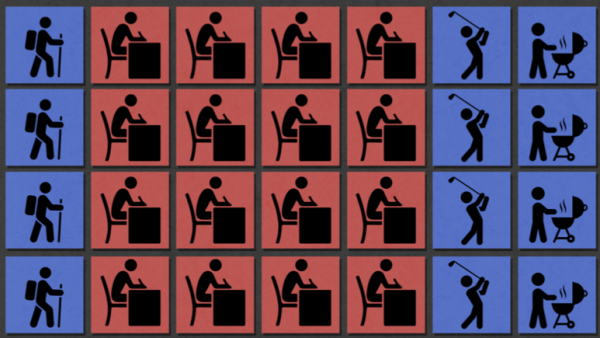

The Dow Jones dropped 1,500 points in just one day earlier this month. The market has begun to go back up, however it is still oscillating.

“It gets a little complex, but, barring anything weird happening, I would say there’s no need for panic,” said Triton business teacher Richard Fisher.

In the final hour of trading on Monday February 5th, the Dow Jones Industrial Average dropped 1,500 points. Although this is the largest point drop in history, most say there is no reason to worry.

Although this is the largest point drop in history, what most people do not understand is that as time goes on the point value of the Dow increases. It is currently at 25,000 points where in 2010 it was only at 12,000 points. Therefore, a large drop is okay since the total point value is very high.

“We have reached a benchmark called a ‘market correction’. That is approximately a 10 percent reduction in value in stocks,” said Fisher. “Every so often, especially when the stock market is hot, you get an overall cooling off in trading and in stock prices,” Fisher added.

Most students and teachers are not feeling panicked. “It is just a normal bust in the boom/bust economy,” said Senior Amanda Sheehan.

Triton junior Tirth Patel luckily pulled his stocks right before the dip. “Luckily I pulled out my money a few weeks ago, but I would have lost about $100 from the 100 shares I had in one particular stock,” said Patel.

In Mr. Fisher’s principles of finance class, the students play a virtual stock market game where they invest fake money into real stocks. “Right now, out of about 850 students in the region competing in the “Stock Market Game”, Triton student Ben Campbell is in second place. Campbell is taking Principles of Finance,” said Fisher.

Stock expert Michael Reno said, “This is not a crash, just a dip, it is nothing to worry about.” Reno also added that this was expected to happen soon, since the market was so hot.

The only way to see the future of the stock market is to wait and see what happens.