What’s the Point of High School?

High school is supposed to prepare students for life after graduation, out in the real world, but do Triton students feel ready to leave the comfort of these four walls and venture out into the real world on their own?

November 9, 2017

Finding the perfect college or job, applying, and being accepted may seem like the hardest part, but the real work comes after the diplomas are handed out and students can no longer rely on the protection that these four walls provide.

For a majority of high school seniors, moving out for college or to begin one’s career will be the first time the student will be left on their own to be responsible for themselves. Up until then, typically a student’s parents house them, feed them, and make all of the life-changing decisions for them. For Triton’s graduating class of 2018, all of that is about to change.

“I’m scared that I’m going to run out of funds.” said senior Ellie Odoy about her most prominent fear of living on her own next year. Being able to manage one’s finances and make smart fiscal decisions is one of the most important lessons college students learn during their first year.

A 2015 national study by the Ohio State University Office of Student Life found that 70 percent of 18,795 students surveyed from 52 secondary education institutions in the United States feel stressed about their personal finances. Thirty-two percent of students admitted to pushing aside their studies at times because of the amount of financial stress they were under.

Triton offers a financial literacy class called Principles of Finance taught by Mr. Richard Fisher. The class teaches students how to set up lines of credit, manage debt, make smart investments, and more.

According to Fisher, the class covers “…today’s most relevant financial concepts as students examine current financial markets, institutions, and investments.”

Also, Triton offers a Consumer Math class taught by Mr. Ben Colby. In his class, Colby teaches students how to navigate renting an apartment, budget finances, understand taxes and interest, buy a car, and many other “real-world math” topics, according to Colby.

In addition to financial responsibility, students are about to be responsible for many day-to-day chores and tasks.

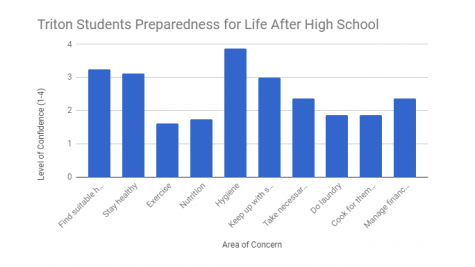

According to a survey of Triton students, more than half said that they do not know how to do their own laundry or cook for themselves.

Many of the students also admitted to feeling wary about taking care of themselves physically with regards to exercise and diet.

In previous years, Triton offered a class called Home Economics where students learned how to cook basic foods, sew, complete other real-life skills. The class was cut in 2012 due to budget cuts. Since this is an area that Triton students feel unprepared for, maybe the administration will look into bringing it back or introducing a similar class to help students be ready for life after high school.

On the positive side, most of the students surveyed felt confident in their ability to find housing and roommates, stay healthy and hygienic, keep up with school work, and take necessary safety precautions.

The following graphic shows the average results of a survey conducted by Triton Voice in October of 2017 of twenty Triton seniors’ responses when asked how confident they were in certain areas: