Understanding Your Taxes

Taxes are for students, too.

November 9, 2018

As a civic duty, taxes by far are the most expensive of the bunch, and sometimes it might feel like your money is just being thrown away.

Taxes can be complicated, confusing, and you might think the government is just stealing your money, but where does that money actually go? In this article, it is my goal that the reader gains insight to a little of the back end part of their taxes and where that big chunk of their paycheck is going.

Every year, a certain percentage of your income goes to the government, often times it is taken directly out of your paycheck. Depending on your level of income, a certain percentage is taken out. The higher your income, the higher the percentage. If taxes are not taken out of your paycheck, you still have to pay them. Say you own a business, you would file under self employment as long as you made over $950 in profits for the year.

Jason Fleming, a Senior Research Administrator of Finance and Compliance at Harvard University, has a few tips for people filing their taxes for the first time. The first tip is to get organized, “gather your employer W-2 tax form, which they will send to you by January 31st; and any other financial and tax documents; then go to IRS.gov or do a quick google search for the tax forms and instructions.”

The second tip is to file your returns even if you do not meet the threshold required to file for state and federal taxes, “Otherwise, if you have had any amount of money withheld from your paycheck you will not be able to get that money back – you need to ‘prompt’ the government to issue you a tax refund by filing a tax return.”

When it comes to saving money while filing taxes, there’s not a lot of options after the release of the new tax code that removed some deductions. Flemings tip is to “… start saving for retirement. Really! It’s never too early. If you’ve studied the effect of compound interest you’ll know why I’m telling teenagers to start saving now.” As you get older, retirement savings from your paycheck are counted as before-tax deductions so essentially you are paying less in taxes by saving for retirement.

“Here’s an example for why you should start saving as early as possible: if you save $100 per year in a retirement account that earns 7% annual interest, your account will be worth $37,800 by the time you retire at age 65; however, if you wait to start saving that $100 per year until you are 30, that account will only have $15,900 by the time you retire,” said Fleming.

Mr Chad Richard teaches U.S. History at Triton and dives into the periods of history in the United States before there were any forms of government benefits. This was in a time that the US was at its highest level of unfettered capitalism and there was no assistance available to people struggling in the economy. When the country collapsed in 1929 and unemployment rose to 25%, the government needed to change its ways and add various ways to help its people. Those benefits still exist today.

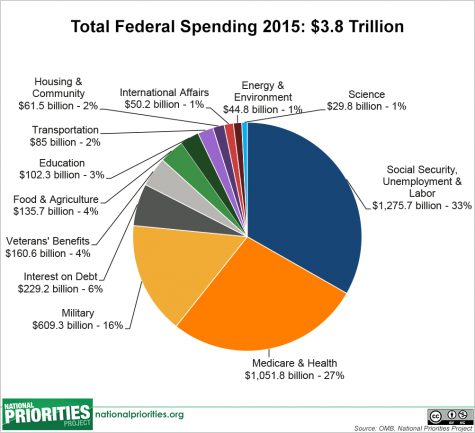

“There’s a few big ticket items like social security, medicaid, medicare, and the military,” says Richard. These are the things that take the biggest percentages of government spending.The ways that the government splits its money is a big complicated equation and there are many factors.

“Taxes even go to those things that we don’t think about every day but are very important to running the country,” said Richard. These things can include roads, bridges, airports, and several other things that not only benefit businesses but also the individual.

There are some things that the government may put money towards that you disagree with. Maybe they put too little or too much towards a certain cause. We can all agree the benefits of the government having your back whether it be protection, various forms of help if your struggling financially, or just nice roads that allow you to get from point A to point B are worth it. “Sometimes (you) put extra money into the pool, it may not always get spent how you hoped or how you wanted but sometimes it’s worth that investment,” said Richard.

By paying your taxes, everyone benefits including yourself. It may seem like the money goes entirely to programs that help people in need and even though you might not be included that group of people, if you were, you’d want the assistance. It’s difficult to picture the country as the world super power that it is today without its citizens paying their share.

Mr Richard Fisher teaches principles of finance at Triton which focuses on the understanding of your money and how to make financially sound decisions throughout your career. Taxes are one of those things that nobody wants to think about but everyone has to pay.

Fisher said the importance of paying taxes is “it’s what enables us to have a country.” He doesn’t mind paying taxes knowing that it’s going towards the country.

“As a system of laws and checks and balances, we need that income, but the way it’s spent is a huge problem,” said Fisher. In his class, he teaches the basics of financial literacy and he said “I’m asking everybody in the class to do something that the government doesn’t do, and that’s pay attention to their income and expenses. There’s no emphasis in government on maintaining a balanced budget.”

It’s hard to say that the government is efficient in the way they spend tax dollars just looking at the overall debt topping 22 trillion dollars, but we all have to pay them and everyone has something to gain from the benefits.